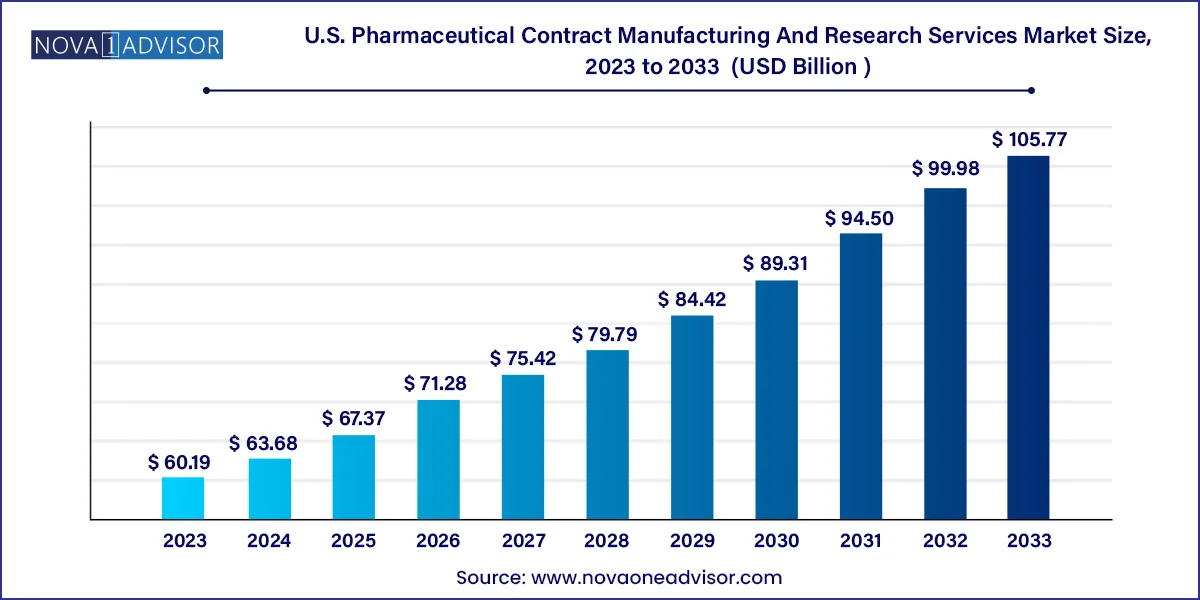

The U.S. pharmaceutical contract manufacturing and research services market size was valued at USD 60.19 billion in 2023 and is projected to surpass around USD 105.77 billion by 2033, registering a CAGR of 5.8% over the forecast period of 2024 to 2033.

The U.S. pharmaceutical contract manufacturing and research services market plays a pivotal role in the modern drug development and commercialization landscape. As the pharmaceutical industry faces growing pressure to reduce costs, accelerate time-to-market, and manage complex regulatory and technological requirements, contract manufacturing organizations (CMOs) and contract research organizations (CROs) have become indispensable strategic partners.

Contract services span a wide range of offerings from early-stage drug discovery and clinical trials to formulation development, active pharmaceutical ingredient (API) production, and final drug packaging. This market enables pharmaceutical and biotech companies to focus on core competencies such as innovation and marketing, while outsourcing highly specialized, capital-intensive tasks to expert vendors.

In the United States, a mature regulatory environment, an advanced healthcare infrastructure, and a strong base of biotech startups and global pharma leaders drive robust demand for contract services. The COVID-19 pandemic further spotlighted the sector’s agility, as CMOs and CROs were instrumental in scaling vaccine and therapeutic manufacturing, facilitating decentralized clinical trials, and ensuring global supply chain continuity.

This market’s growth trajectory is shaped by multiple factors: a surge in biologics and personalized medicine, increasing complexity of drug formulations, rising R&D investment, and a shift from fixed to flexible operational models. As pharmaceutical companies seek greater scalability and regulatory compliance, the contract manufacturing and research services sector is poised for long-term expansion in the U.S.

Increased Outsourcing of Complex Biologics: As biologic drugs gain market share, CMOs are scaling up capabilities for monoclonal antibodies, mRNA therapies, and cell and gene therapies.

Rise in End-to-End CDMOs: One-stop solutions combining development, manufacturing, and packaging services are in high demand.

Shift Toward Advanced Drug Delivery Systems: Demand for novel formulations such as sustained-release, nanoparticle, and inhalable drugs is rising.

Expansion of Oncology-Focused CRO Services: Cancer trials dominate the research segment, prompting investment in biomarker analysis and precision oncology platforms.

Integration of AI and Digital Tools in Research: AI-powered protocol design, patient recruitment, and remote monitoring are streamlining drug trials.

Decentralized and Virtual Clinical Trials: Especially post-COVID, CROs are offering hybrid trial models to reach broader patient populations.

Flexible Manufacturing Platforms: CMOs are adopting single-use bioreactors and modular facilities to accelerate batch transitions and reduce contamination risks.

Regulatory Harmonization Across North America: FDA engagement with sponsors and CROs is facilitating faster IND and NDA pathways.

Pharma-CRO Partnerships for Orphan Drug Development: The rise of niche, targeted therapies for rare diseases is creating long-term outsourcing contracts.

Sustainability in Manufacturing: Green chemistry, waste reduction, and energy-efficient operations are becoming key differentiators for CDMOs.

| Report Attribute | Details |

| Market Size in 2024 | USD 63.68 Billion |

| Market Size by 2033 | USD 105.77 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 5.8% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

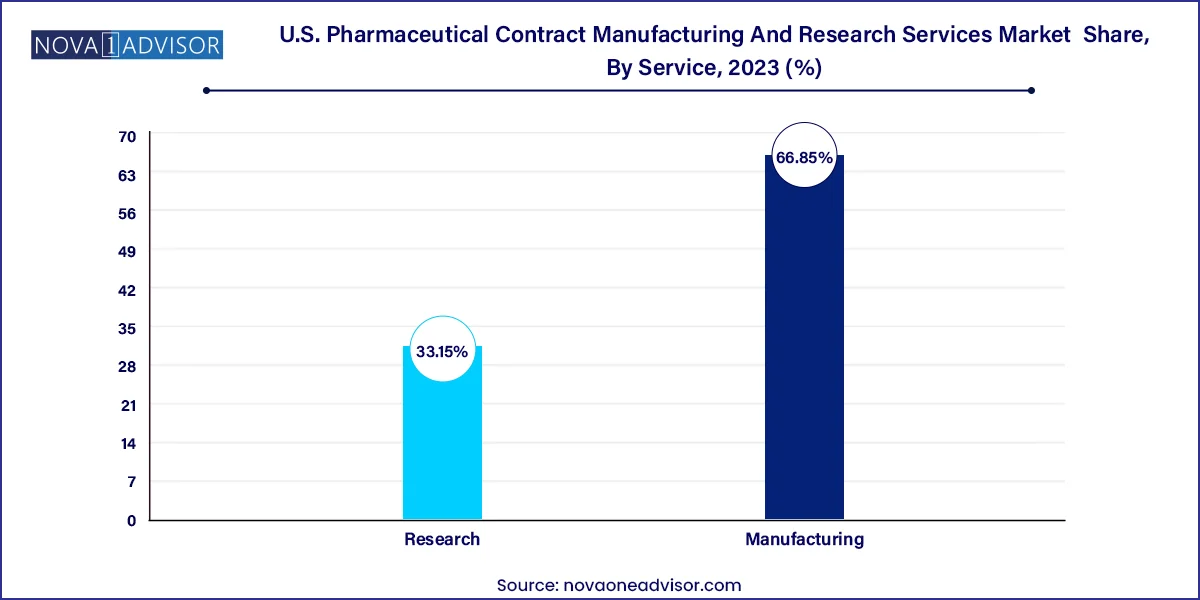

| Segments Covered | Service |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Catalent; Pfizer (CentreOne); Charles River Laboratories International, Inc.; Albany Molecular Research, Inc.; Laboratory Corporation of America Holdings (LabCorp); IQVIA; Baxter BioPharma Solutions; Lingand Pharmaceuticals; Thermo Fisher Scientific, Inc.; AbbVie, Inc.; West Pharmaceutical Services |

A key driver in the U.S. pharmaceutical contract manufacturing and research services market is the growing complexity of drug development and the corresponding need for highly specialized capabilities. Today’s pharmaceutical pipeline includes a significant proportion of biologics, gene therapies, antibody-drug conjugates (ADCs), and combination therapies that require advanced infrastructure, process controls, and regulatory expertise.

Many pharmaceutical companies, particularly small and mid-sized firms, lack the in-house capabilities to support complex manufacturing processes or conduct niche clinical research. Even large pharma companies prefer to outsource certain phases of development and manufacturing to focus internal resources on innovation and commercial strategy.

The need for specialized services such as sterile fill-finish, high-containment manufacturing, and customized clinical trial protocols is fueling demand for experienced and technologically equipped CMOs and CROs. This driver is not only expanding the market size but also elevating the technical and quality benchmarks across the industry.

Despite its growth, the market is constrained by capacity limitations and supply chain disruptions, particularly in high-demand segments like sterile manufacturing and cold chain biologics handling. The demand for complex biologics and fast-track drug approvals has, in some cases, outpaced the available capacity among CMOs, leading to extended lead times and project delays.

In addition, the COVID-19 pandemic exposed vulnerabilities in global raw material sourcing, transportation networks, and quality assurance processes. These challenges have prompted a re-evaluation of just-in-time manufacturing models and raised the need for risk diversification and geographic redundancy.

Smaller CROs and CMOs may also struggle to secure long-term contracts or invest in advanced capabilities due to capital constraints. These limitations affect scalability, responsiveness, and, in some cases, the ability to meet regulatory inspection criteria, hindering the overall market potential.

A significant opportunity for growth lies in contract services tailored for personalized medicine, orphan drugs, and small-batch specialty therapeutics. As the healthcare paradigm shifts toward individualized treatment, especially in oncology, immunology, and rare diseases, drug developers require partners capable of handling low-volume, high-complexity manufacturing and specialized clinical trials.

CMOs offering small-batch sterile filling, single-use technology, and flexible production suites are increasingly being chosen for these applications. Meanwhile, CROs with expertise in genomics, biomarker development, and adaptive trial designs are helping drug developers optimize development timelines for targeted populations.

Moreover, regulatory incentives like the Orphan Drug Act and FDA’s Real-Time Oncology Review (RTOR) program are encouraging rapid development of niche therapies, creating a robust pipeline of candidates requiring outsourced services. Vendors that can meet the personalized, patient-centric needs of this evolving market stand to gain significant competitive advantage.

Finished dose formulations dominate the manufacturing segment, representing the last critical phase before product commercialization. Solid formulations especially tablets and capsules account for the largest share within this subsegment due to their wide use across therapeutic classes, low manufacturing costs, and favorable patient compliance. CMOs offer a broad range of finished dose services, including granulation, tableting, coating, and encapsulation.

Advanced drug delivery formulations are the fastest-growing area, driven by increasing demand for controlled release, nanoformulations, and targeted delivery. Pharmaceutical companies are actively outsourcing these functions to CDMOs with expertise in novel excipients, particle engineering, and proprietary delivery platforms. The growing focus on improving patient adherence and enhancing bioavailability is making this subsegment a major growth driver.

The United States remains the epicenter of pharmaceutical contract services, owing to its advanced regulatory framework, large concentration of biotech firms, and globally influential pharmaceutical industry. The U.S. Food and Drug Administration (FDA) is deeply engaged with contract service providers, and its accelerated approval programs encourage the use of specialized CROs and CDMOs to meet stringent clinical and quality timelines.

The country hosts several clusters of innovation Boston, San Diego, San Francisco, and Raleigh-Durham where hundreds of biotech startups and research institutions collaborate with CDMOs for drug development and GMP manufacturing. These hubs provide a fertile ground for new contract service partnerships.

Additionally, the presence of academic medical centers and integrated research hospitals fuels demand for protocol design, early-phase trials, and advanced manufacturing techniques. The U.S. government’s investments in pandemic preparedness and national biodefense are also channeling funds into contract research and manufacturing infrastructure.

March 2025: Thermo Fisher Scientific expanded its CDMO facility in North Carolina, adding capabilities for high-potency API manufacturing and sterile fill-finish for biologics and ADCs.

February 2025: Catalent signed a multi-year partnership with a leading oncology biotech company to support personalized medicine drug product development and commercial-scale packaging in the U.S.

January 2025: Lonza launched a new small-batch GMP manufacturing suite in Massachusetts, specifically designed for rare disease therapies and orphan drugs.

December 2024: Labcorp Drug Development announced the integration of AI-based analytics into its decentralized trial platform to support oncology and vaccine research protocols.

November 2024: PPD (a Thermo Fisher company) opened a new biomarker lab in San Diego to support genomic and transcriptomic analysis for early-phase clinical trials.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Pharmaceutical Contract Manufacturing And Research Services market.

By Service